Retirement Planning

Retirement planning is equally important for those still working and for those who have already retired. In both cases, you’ll want to have enough saved —and to manage it well—to last the rest of your life.

Changes in tax and other legislation compounds the risk of error. With qualified plans (such as IRA, pension, profit-sharing, 401(k) and Keogh plans), the timing and amount of withdrawals are critical in order to avoid additional tax penalties. And, if you have accumulated significant qualified plan assets you may face additional problems, including the “Double Tax Dilemma,” under which the government can tax these assets twice.

Saving for retirement and managing those funds are integral parts of the Kelm Financial Services planning process. During the financial planning process, Premier will help you clarify your goals and needs during retirement.

We will then help you make educated financial decisions so you can attain those goals and meet your needs.

Call Kelm Financial Services Today!

At Kelm Financial Services Inc, we apply over decades of experience in helping our clients navigate this process, working closely with your team of legal, tax and investment advisors or ours. We patiently will stand by your side and walk you through this process until you are comfortable with defining your goals, then provide you with a thorough analysis of strategic alternatives for your situation.

Through meticulous attention to detail and our vast industry knowledge and resources, we make sure our clients’ assets are not lost to unnecessary income or estate taxes. Our focus is to insure that your Family and the Charities you support receive the maximum benefits possible when the wealth eventually is transferred.

Retirees Need Less Stocks, More Annuities

NASDAQ Retirees Need Less Stocks, More Annuities RETIRING: Retirees [...]

Life Insurance Policy Audits

Life Insurance Policy Audits Unlocking the “Mystery” of life [...]

Life Insurance Beneficiary Mistakes

Overlooking details I’ve reviewed over two dozen life insurance [...]

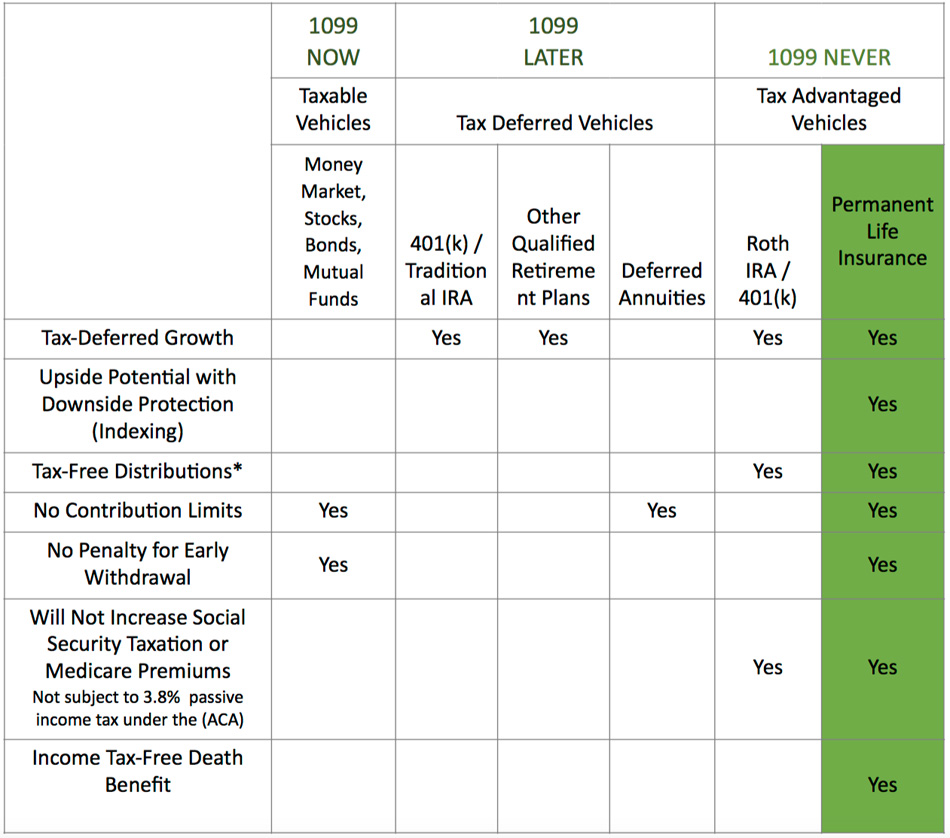

Below is an illustration that we use help our clients understand the tools that can help leverage each client into reaching their retirement goals

Bucket #1

Taxable Vehicles

Bucket #2

Taxable Vehicles

Bucket #3

Taxable Vehicles

I can decide when to pay Taxes?

YES, The Financial Decisions you make NOW will Determine How Much You Will Have in Each 1099 Bucket.

When it comes to how to save for retirement, there are enough options to make anyone’s head spin. While each approach has its benefits, when it comes to taxes, not all retirement savings vehicles are created equal.

As April 15 approaches, now is as good a time as any to review the three “tax buckets” of retirement savings: tax deferred, tax-free and after tax. You want every saved penny to help you on your path to retirement readiness, so spend time during tax season to make sure you understand and are taking advantage of retirement savings options.

For most people, the tax deferred bucket makes up the bulk of their retirement savings through a workplace 401(k), 403(b) or traditional individual retirement account (IRA). Tax deferred accounts* tap pre-tax dollars, with retirees paying the taxes when the money is withdrawn in retirement.

These savings lower your taxable income today and offer a convenient, easy way to save for retirement. Yet, retirees may not take into account the tax hit this bucket receives in retirement when they look at their total savings and plan retirement income. In addition, marginal tax rates could rise for retirees in the future, meaning a bigger bite out of savings down the road.

The second bucket of savings taps after tax money and lets earnings grow tax-free. Through a Roth IRA or Roth 401(k), contributions are after tax and no taxes are paid when the money is withdrawn in retirement.

The Roth may benefit those who have more time to let the money grow tax-free. In addition, savers do not need to withdraw from the Roth when they turn 70½ as they do with a 401(k), 403(b) or traditional IRA. This means retirees can allow these savings — which continue to compound — to pass along to their heirs untouched. I often encourage retirees to withdraw their Roth savings last due to the tax-free growth potential.

The third bucket of retirement savings taps after tax money through vehicles including money markets, mutual funds, brokerage accounts, stocks or bonds. As this money grows, interest and dividends must be paid annually. These savings can be withdrawn prior to turning 59½ without any penalty, offering more flexibility to anyone contemplating an early retirement or needing more flexibility with their money. Part of these savings, invested more conservatively, can also serve as a retiree’s extra emergency fund to help pay for the unexpected.

Integrating two or three of these tax buckets into your retirement savings strategy can help improve your retirement readiness. Many different factors go into one’s retirement readiness, including the tax strategy. Smart tax planning with your retirement savings can lead to a more comfortable lifestyle in retirement and greater financial flexibility.

At Kelm Financial Services We Focus on Bucket #3.

We’re prepared to work with you in the way that best serves your goals.

Providing cutting-edge financial planning solutions for Families and Business Owners since 1987