Income & Tax Bracket Planning When Do You Want Your 1099?

The Three 1099 Buckets of Income – Overview

WHAT

I can decide how and what my tax bracket can be?

The answer is, YES

The Financial Decisions you make NOW will Determine How Much You Will Have in Each 1099 Bucket.

Income Will Fall into One of the Following Three 1099 “Buckets”.

Income Will Fall into One of the Following Three 1099 “Buckets”

BUCKET 1

Taxable Vehicles

1099 NOW!

Income from this Bucket Will Be Taxable in the Current Tax Year at the Prevailing Tax Rates & Capital Gains at Your Income Level.

After-Tax Dollars invested in the Following:

BUCKET 2

Tax Deferred Vehicles

1099 LATER

Income from this Bucket will Be Taxed When Withdrawn. Taxes Are Due the Year that Funds are Withdrawn at the Prevailing Tax Rates at That Time.

Pre-Tax Dollars Invested in the Following:

BUCKET 3

Tax Advantaged Vehicles

1099 NEVER!!

Income from the Following Bucket will NEVER BE TAXED*.

After-Tax Dollars Invested in the Following:

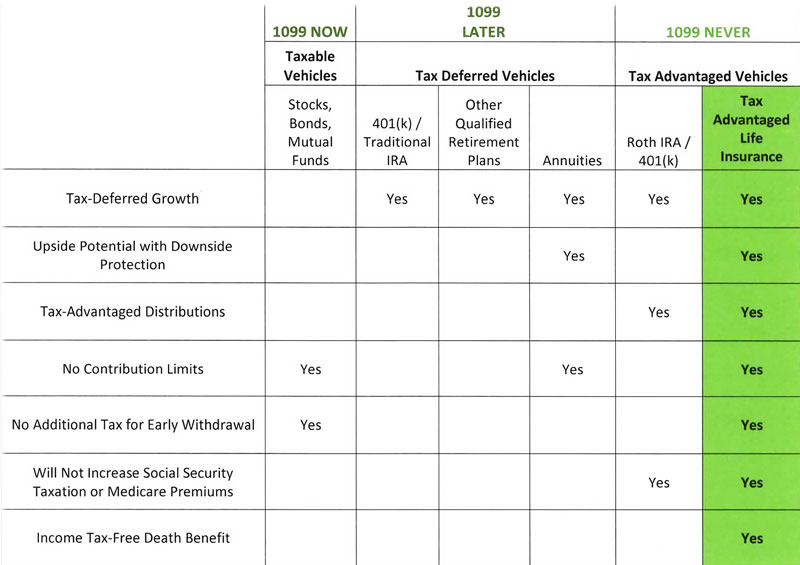

The Three 1099 Buckets of Income – Comparison

*Tax-Free Income is based on a properly structured and funded policy. Utilizing Partial Surrenders and zero or low cost loans, while keeping the policy inforce.